|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

01 31

Industrial Capitalism Vs Finance Capitalism

A critical issue facing the environmental movement is the way we structure our economic policies. The world of high-brow economic theory has waged a pitched battle for about two hundred years over the benefits of Industrial Capitalism versus Finance Capitalism. Now, if you've read Janes Jacob's "The Nature of Economies," you know that the way we structure our financial markets can have a cause and effect relationship on the environment. Some feel that when FInance Capitalism won out in the 1970s the world took a turn towards complete environmental collapse.I am not an economist and cannot claim any great insight into the clash between these systems. I have, however found a compelling essay that explains it well. Jonathan Larson is the author and this is posted on his website. (I am assuming creative commons copyright on this essay. Please go to Mr. Larson's site for more essays on his theories of "Elegant Technology ... economic prosperity through environmental renewal.") Economics: A Matter of Life or Death by Jonathan Larson (first posted at European Tribune, Jan 18, 2007) When I took economics at the University of Minnesota in the early 1970s, one of my professors was Walter Heller. Heller was President Kennedy's Council of Economic Advisors chairman and would claim, quite seriously, that he taught Kennedy Keynesianism. In those days, the Keynesians were utterly dominant in academe and government. There were so many of them, they had subdivided into various schools. It could be argued that Heller represented the right wing of the Keynesian school. His economics department used the Neoclassical Samuelson text and his primary accomplishment in the Kennedy administration was his tax cut suggestion. But even from the right wing of the Keynesian impulse, Heller was quite clear that he thought folks like Milton Friedman were at best mistaken and quite possibly insane. Yet by the time I graduated, the acolytes of Friedman were running the economy of Chile with their sights set MUCH higher. And yes, they would set the economic operating assumptions for planet earth for a generation. There has been a lot of invented terminology to describe the change in fortunes of the Keynesians and the Friedmanites. But the MOST descriptive was that it marked the change from Industrial to Finance Capitalism. If River Rouge was the defining symbol of Industrial Capitalism, then the archetypical example of Finance Capitalism was Enron. Enron embodied the major flaws of Finance Capitalism--it was only possible because of economic deregulation, it relied on a willing suspension of disbelief in all reasonable measures of prudence, it sold cotton-candy products like weather futures, and it relied on industrial sabotage to make its fantasy profit targets. All of these maneuvers were done in public with the main movers featured prominently on the covers of the business press. Phil Gramm, who shepherded Enron's enabling deregulation through the Senate, was a regular talking head on the television news shows because he was a true believer who preached, as a trained economist, that deregulation was necessary and virtuous. This was not some sort of invisible conspiracy, this was a seizure of the intellectual high ground. But, scream the apologists for Finance Capitalism, we are not industrial saboteurs, vandals, and rip-off artists. We are SCIENTISTS and one of our members has been rewarded with a Nobel since 1968. And sure enough, the defenders of Finance Capitalism have erected an awesome intellectual apparatus to justify their crazy ideas and when all else fails, they point to rising numbers at their Meccas--the trading pits of the various stock exchanges world-wide. The problem is that under the rules of Finance (...read more...)

01 29

Atwood Does Alberta

Margaret Atwood, photo from www.greenpeace.ca Reading Toronto contributor Margaret Atwood (oh, and noted Canadian author) gave Richard Helm of the Edmonton Journal an interview this week and the Alberta oil patch may never be the same. What’s Atwood’s position on Alberta’s energy industry?

Congratulations to Atwood for continuing to use her voice to advance environmental concerns.

01 25

Toby Heaps: Davos Diary

---------------------------- Environment themes and their relationship with the economy, particularly climate change, are hot this year in Davos. Case in point. Last night I was waiting outside the Belvedere, the main Davos Hotel where the glitterati gather at night. As I was running a little late and it was quite a long line to get inside the hotel through the security check, I wondered if anyone would notice if I budded a little. But when I noticed that the Premier of Quebec was waiting behind me in the cold line, my better instincts suggested that was not a good idea, especially in Switzerland. The Premier and I were both heading for similar events. He was off to speak on a panel with UK Conservative Leader David Cameron on climate change and energy security, and I had a dinner to co-host. I was looking forward to the dinner for two reasons: to hear what the world’s leading investment bankers had to say on taking the good fight (climate change, human rights) to the political stage, and I was curious how the red-blooded Wall Street crowd (Goldman Sachs, JP Morgan, Swiss Re) would appreciate the 100 per cent vegetarian-meal I had ordered for all of them. It turned out that the hi-carb but low-carbon veggie-lasagna was a big hit, but my dinner conversation was interrupted when a senior Canadian aluminum company executive had to go outside to answer questions from a newspaper survey on whether his company supported the Kyoto Protocol and what they were doing about it. After dinner, a senior investment banker from the US started talking about his company’s fleet of hybrids and eco-efficient headquarters. I took a big gulp of red wine, hoping to dull my senses to the coming barrage of PR. But then the boom lowered. Investment banker after investment banker stated the obvious: banks have a small direct effect on the environment but through financing activities they have a huge indirect effect, bigger than many governments. One of the top investment bankers in the US said with the same glint in his eye as a prospector finding gold: “this area [renewable energy] is very hot right now in our firm to be spending money on.” The head of an industry group focused on corporate responsibility noted that when Goldman Sachs included environment and social metrics in its energy sector analysis, it had a bigger impact than a 1000 socially responsible investment funds could ever have. But the bottom line, the consensus went, was there must be a broader economic basis for protecting the environment. In the words of one US bank chief, “there is a clear social cost to destroying the environment and we see a role for government to play in helping measure that cost, and in getting money from the destroyers to the people they hurt.” He backed up his comments disclosing that his firm lobbies US Congress for stricter environmental regulations and gives money to political action committees on this basis. A UK climate lobbyist pointed out that while winners go to market, losers go to Washington. The consensus among the participants was that the winners need to go to Washington too, in order to help balance out the aggressively negative lobbying by the losers from policies (i.e. carbon taxes) that would align economic drivers with by providing accountability for environmental costs. As a fair amount of the discussion had to this point focused on the implications of (...read more...)

01 24

Global 100 Gets Attention

In case you missed yesterday's Globe and Mail, Corporate Knights' Global 100 got some good coverage. In cooperation with Innovest Strategic Value Advisors, Corporate Knights publishes a list of the world's top 100 most sustainable companies. Here is that list:The 2007 ListThe Global 100 list for 2007 (alphabetical | by country | by sector/industry)

World Economic Forum Launches Today: Toby Heaps Is There

What is the World Economic Forum? Here is the Wikipedia’s introduction:

Here is a video about last year’s conference.

01 23

What Canadians Really Think About The Environment

Angus Reid, the polling company, announced today that the issue most concerning Canadians is the environment. Well, tell us something we didn’t know. The main stream press has so many stories about sustainability these days that the venerable Canadian news institution, The Globe and Mail, should rename itself, “The Global Warming Report.” Take a look at today’s paper and count the environment related stories. See what I mean?

Getting back to the Angus Reid story—today they made public this research: 19% of us are concerned with health care while 35% think the environment is our most important concern. Ten years ago the environment would not have even made the top ten let alone number one. Here are the numbers:

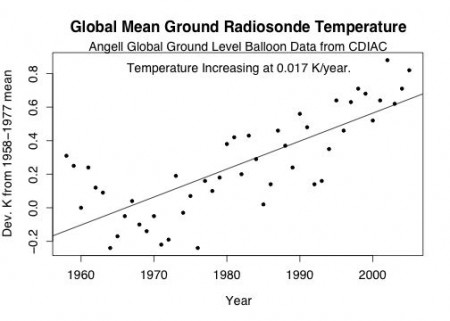

Maybe these polling results are caused by quantifiable data like this:

Or maybe our concern is the result of these stories kindly made available by http://www.sourcewatch.org:

01 22

The End Of Global Warming Denial?

We have a pop quiz for all our green news aware readers: What do chemical giant DuPont, aluminum producer Alcan, heavy-machinery company Caterpillar, and and BP’s U.S. subsidiary all have in common? . . . If you said they all pay “experts” to deny that global warming exists you’d be wrong - at least for this question. Want to try again? O.K., O.K., you’re never going to get this. Those four giant companies are part of a new group called the “United States Climate Action Partnership (USCAP).” Their plan is to reduce greenhouse gasses by 10-30 percent over the next fifteen years. Now, as startling and perhaps unexpected as that is what is really remarkable about the news is that they are urging U.S. President George W. Bush—you know, the guy who systematically purged the Federal Government of its pro-environment voices—to do something about global warming. And they are doing it on the eve of the President Bush’s “State of the Nation” address. If your jaw just hit the floor we can wait a minute while you compose yourself. (Wait, if Stephen Harper can have a green epiphany then maybe it is not that surprising.)

What is even more unexpected is that global warming denier Exxon Corporation is cutting back its funding for anti-global warming propaganda. At least according to the Independent Newspaper:

Humour aside for a moment, these kinds of bureaucratic organizations will hold corporations to their promise of a sustainable future. In fact, the ISO system probably has done more to entrench the idea of sustainability in manufacturing than any thousand green lectures on the future of the planet. That’s just the way engineering-driven companies work. So, let’s applaud this move on the part of big companies and do our best to keep this momentum going.

Here is the USCAP mission statement from their recent press release:

|

Contribute to the MESH Cities intelligent city database. Click here.

Read what people are saying about the environmental issues that impact us all

News about wind energy

News about green investing

Blog posts about electric cars

|

The best green news sources on the Net

Treehugger

Eco Worrier

Inhabitat

Lime

World Changing

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

By Toby Heaps: Editor of Corporate Knights magazine which publishes the annual Global 100 Most Sustainable Corporations list each year at the World Economic Forum.

By Toby Heaps: Editor of Corporate Knights magazine which publishes the annual Global 100 Most Sustainable Corporations list each year at the World Economic Forum.

The World Economic Forum launches today in Davos, Switzerland and Corporate Knights editor Toby Heaps is there along with our publisher, Karen Kun. Follow Corporate Knights Forum as Toby posts his journal on this year’s proceedings. Global warming is a major topic at this year’s conference:

The World Economic Forum launches today in Davos, Switzerland and Corporate Knights editor Toby Heaps is there along with our publisher, Karen Kun. Follow Corporate Knights Forum as Toby posts his journal on this year’s proceedings. Global warming is a major topic at this year’s conference: